Zomato’s equity Decline in Stock Value: Is Now a Good Moment to Invest?

In the fourth quarter of FY24, Zomato’s equity , a meal delivery platform, recorded a consolidated net profit of ₹175 crore, compared to a loss of ₹188 crore in the same period the previous year. Compared to the December quarter’s reported ₹138 crore, the net profit increased by 27%.

Early on Tuesday, following the release of the company’s Q4 earnings, Zomato’s equity dropped by 6%. Zomato’s equity dropped as much as 5.98% on the BSE, reaching ₹182.10 a share.

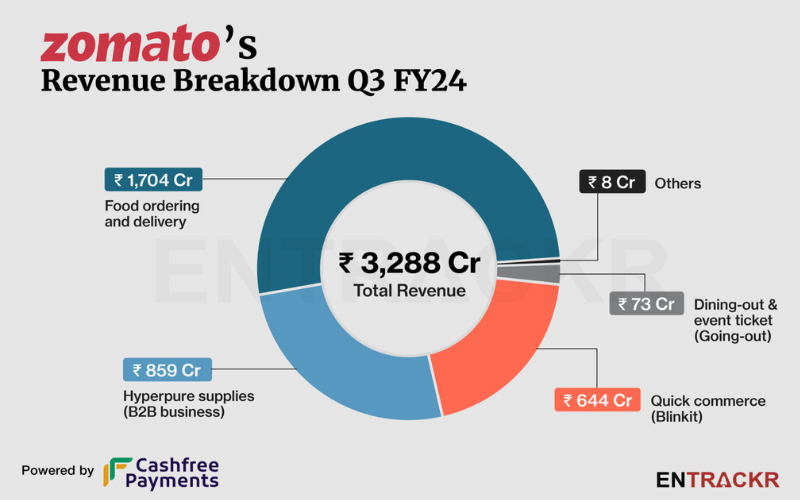

In Q4FY24, Zomato’s operating revenue climbed by 73% year over year to ₹3,562 crore from ₹2,056 crore. The gross order value (GOV) increased to ₹13,536 crore, or 51% YoY, for B2C enterprises during the March quarter.

Operating-wise, the company reported an EBITDA of ₹86 crore, up from a loss of ₹226 crore in the same time previous year.

Blinkit, Zomato’s equity fast-commerce division, reached operational EBITDA break-even in March 2024.

With several analysts upping their target price for the stock due to Blinkit’s ongoing outperformance, analysts maintained their bullish outlook on Zomato’s equity share.

Analysts’ opinions on Zomato’s Q4 earnings and share price are as follows

Emkay Global Financial Services-

- Zomato’s equity reported consistent operating results, with revenue exceeding the company’s projections. However, higher-than-anticipated ESOP costs were the cause of the margin failure.

- In light of Blinkit’s slower profitability from its ambitious retail expansion plan and increasing ESOP costs, the brokerage firm has decreased FY25E EPS by almost 20% while maintaining most of its predictions for FY26E earnings per share (EPS).

- With a Zomato’s equity share price objective of ₹230 per share on a SOTP basis, it kept its ‘Buy’ rating. Blinkit, cash & other investments, and food delivery were valued at ₹93 per share (DCF basis), ₹121 per share (BV), and Rs17 per share (BV).

Institutional Equities Nuvama–

- By end of FY25, Blinkit hopes Zomato’s equity increases the number of dark stores from 525 in Q4 of FY24 to 1000. Nuvama Institutional Equities said that although Zomato equity would have an effect on short-term profitability, it will solidify Blinkit’s position as the clear market leader in rapid commerce.

- Using SOTP, it assigns a $10 billion value to food delivery on Zomato and a $13 billion value on Blinkit. The upgrade resulted from Blinkit’s value rising as a result of its unexpectedly rapid growth and obvious leadership in rapid commerce.

- Nuvama increased the target price for Zomato’s equity shares from ₹180 to ₹245 while keeping a “Buy” recommendation on the stock.

Elara Capital on Zomato’s equity –

- Zomato’s strong moat in the food industry, which could see it post an adjusted EBITDA CAGR of 47% in FY24–26E, and superior execution for Blinkit (market leadership), aided by better customer experience compared to peers (on-time delivery, better product assortments), are the reasons Elara Capital said it still favors Zomato.

- Due to stronger growth for Blinkit/Hyperpure, Zomato’s equity increased the consolidated revenue expectations for FY25E and FY26E by 22% and 33%, respectively. However, due to reduced EBITDA for Blinkit (whose priority is expansion) and higher ESOP expenses, its consolidated earnings upgrade for FY25E and FY26E is only 7% and 3%, respectively.

- The firm upped its target price for Zomato shares to ₹280 from ₹250 and kept its “Buy” recommendation.

- Zomato’s equity shares were down 4.96% at ₹184.10 a share on the BSE at 9:20 a.m.

Is Swiggy or Zomato more profitable?

- Swiggy hopes to start making money by the second part of this year. However, given its FY23 performance, it still appears like a far-off dream. However, Zomato generated a profit of INR 116.90 crore in the fiscal year 2023. A total of 5506.90 crores were made.

- The Zomato’s equity is up 191% in a year. On the BSE, 2.01 lakh shares of Zomato were traded, translating into a turnover of Rs 3.20 crore. The company’s market value increased to Rs 1.41 lakh crore on Tuesday. For the third consecutive quarter, Zomato turned a profit in December 2023.

- Zomato saw a 73% increase in operations revenue during the quarter that ended on March 31, 2024, resulting in a net profit of Rs 175 crore as opposed to a loss of Rs 188 crore during the same time the previous year.

- Even with the recent decline in share price and increasing losses, Zomato’s equity is still in a strong position to benefit from the rising demand for online meal delivery services in India and other countries. The business has a competitive advantage in the market thanks to its robust brand presence, wide restaurant network, and cutting-edge products.

Thinking About Market Sentiment

- The way investors perceive Zomato’s future trajectory will impact its share price movement, and market sentiment is a major factor in setting stock prices. Value investors may get a chance to buy more Zomato stock at a lower price due to the recent decline in share price.

- But before making any decisions on their investments, investors need also proceed with prudence and complete due diligence. To evaluate Zomato’s long-term investment prospects, one must consider its competitive positioning, growth strategy, and business fundamentals.

conclusion

In conclusion, investors have a unique chance to assess the stock’s investment merits in light of Zomato’s recent share price decline. Despite facing obstacles including growing losses and fierce competition, the company’s solid market position and promising growth make it a desirable long-term investment.

Before making an investment, investors should carefully analyze the risks and rewards, as well as aspects including market conditions, industry trends, and Zomato’s strategic direction. Investors can make decisions that are in line with their financial goals and risk tolerance by doing extensive research and remaining educated.

This content is informative and remarkable